John W. Rogers, Jr., founder of Ariel Investments, recently discussed the school he created to teach Chicago kids about financial literacy in an interview with Black Enterprise.

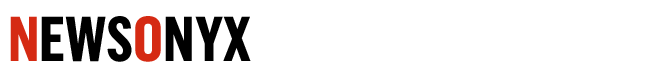

Rogers’ Ariel Community Academy was founded in 1996 with a curriculum designed to expose inner-city youth to basic financial literacy practices, learn the key to obtaining generational wealth, and invest for the long-term.

“To me, financial literacy is not just about saving, credit cards, retirement, and home mortgages. All those things are important,” Rogers said. “But equally important is understanding how to invest in the equities market and compound money. Long-term stock market returns have substantially outperformed the returns on savings accounts.”

The key to successful investing, Rogers told the publication, was starting early. The savvy businessman, who founded the first Black-owned mutual fund company in the country, said his interest in investing and finances began at the age of 12 when he was given stocks instead of toys as gifts.

He passed that passion on to Ariel Community Academy students. The southside school goes from grades pre-kindergarten through eighth grade and teaches children how to draft business plans and manage stock portfolios. Each kindergarten class begins with $20,000 to invest, and when they complete eighth grade, each student is given a share of the profits.

“I’m replicating what my dad did for me. We are giving kids the opportunity to invest in real stocks with real money. Secondly, we’re exposing kids to money managers and stock pickers who look like them. That inspires the kids and shows them that they can do it too,” Rogers explained.

The entrepreneur, whose mantra is “people undervalue time, and they overvalue money,” advised that if you are interested in becoming financially literate, understanding accounting is critically important because “you can get into a lot of trouble if you buy a company that has a great story but a weak balance sheet.”

He also advised that folks read.

“Read as much as you can about investors who have been successful. Listen to Warren Buffett. Invest in your circle of competence. Invest in the industry that you know well and are comfortable investing in.”